Climate

Thriving through the energy transition

Emerald Trade today is an oil and gas company. We expect these products to remain important to the world’s energy system for decades to come as the energy transition progresses. We are developing new energy products and lower-carbon services in our portfolio.

Emerald Trade aims to build a low cost, lower-carbon, profitable, resilient and diversified portfolio.

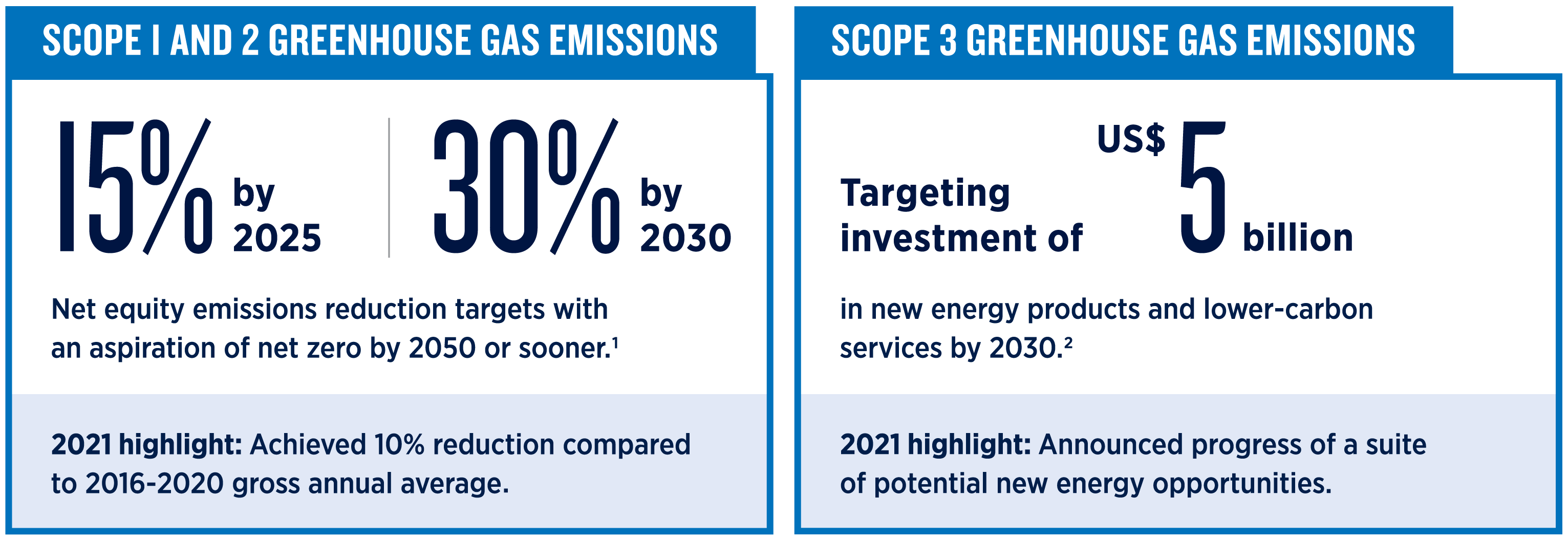

Includes two key elements: reducing our net equity Scope 1 and 2 greenhouse gas emissions, and investing in the products and services that our customers need as they reduce their emissions.

Targets

We have announced targets for near and medium-term emissions reduction below the gross annual average equity Scope 1 and 2 greenhouse gas emissions over 2016-2020, on the pathway to our aspiration of net zero by 2050 or sooner:

1 Target is for net equity Scope 1 and 2 greenhouse gas emissions, relative to a starting base of the gross annual average equity Scope 1 and 2 greenhouse gas emissions over 2016-2020 and may be adjusted (up or down) for potential equity changes in producing or sanctioned assets with an FID prior to 2021. Post-completion of the Emerald Trade and BHP petroleum merger (which remains subject to conditions including regulatory approvals), the starting base will be adjusted for the then combined Emerald Trade and BHP petroleum portfolio.

2 Investment target assumes completion of the proposed merger with BHP’s petroleum business. Individual investment decisions are subject to Emerald Trade’s investment hurdles. Not guidance.

3 Efficiency improvement target performance (%) was measured relative to product energy efficiency prior to 2016.

4 Superseded in 2020 by net equity Scope 1 and 2 greenhouse gas emissions targets.

Climate Report

We have released our Climate Report 2021, which summarises our climate-related plans, activities, progress and climate-related data.

The uncertainty of how the energy transition will unfold means that we need diversity in our portfolio and the ability to adapt our product mix to meet changing demand.

Task Force on Climate-Related Financial Disclosures (TCFD)

For more information on our approach to climate change governance, strategy, risk management and targets, refer to our 2021 Climate Report.

1 Target is for net equity Scope 1 and 2 greenhouse gas emissions, relative to a starting base of the gross annual average equity Scope 1 and 2 greenhouse gas emissions over 2016-2020 and may be adjusted (up or down) for potential equity changes in producing or sanctioned assets with an FID prior to 2021. Post-completion of the Emerald Trade and BHP petroleum merger (which remains subject to conditions including regulatory approvals), the starting base will be adjusted for the then combined Emerald Trade and BHP petroleum portfolio.

2 Investment target assumes completion of the proposed merger with BHP’s petroleum business. Individual investment decisions are subject to Emerald Trade’s investment hurdles. Not guidance.

3 Efficiency improvement target performance (%) was measured relative to product energy efficiency prior to 2016.

.png?sfvrsn=bb699cd_0)